The USD has experienced a marked increase as various central banks pivot towards dovish stances, some signaling such policy shifts even before the upcoming summer. Following the SNB’s recent rate cut, the BoE has also adopted a dovish tone. Furthermore, ECB official Nagel has indicated rising probabilities of a rate cut before summer, intensifying this trend. Consequently, the rate differential is increasingly favoring the USD, as reflected in the current market dynamics.

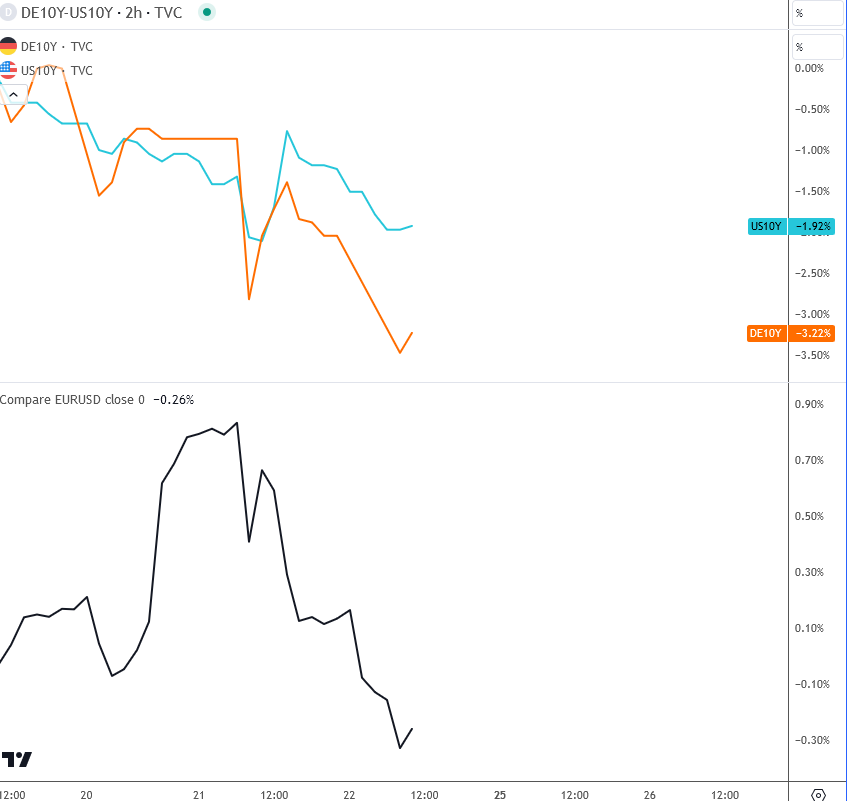

Analyzing the accompanying chart reveals that German bond yields are declining more precipitously than those in the US, elucidating the downward pressure on the EURUSD pair and the concurrent broad appreciation of the USD. The DXY’s energetic recovery underscores a bullish outlook, suggesting a potential for further elevation in the index.

In this context, it is prudent to be cognizant of the possibility of a continued downturn in metal prices, which have been notably weak since yesterday. Silver, in particular, has retreated approximately 4% from its recent peak.

When looking across different FX pairs, it appears that USD can reach higher prices across the board, while DXY is pointing up to 105, then even 106 as drop from the February high unfolded in three waves. It can represent a completed correction or part of a triangle.

Till now just shorting currency during it’s CB rate decision sounds like an “easy” trade for now.

Join me in webinar on Monday for more analysis. Join us here.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.