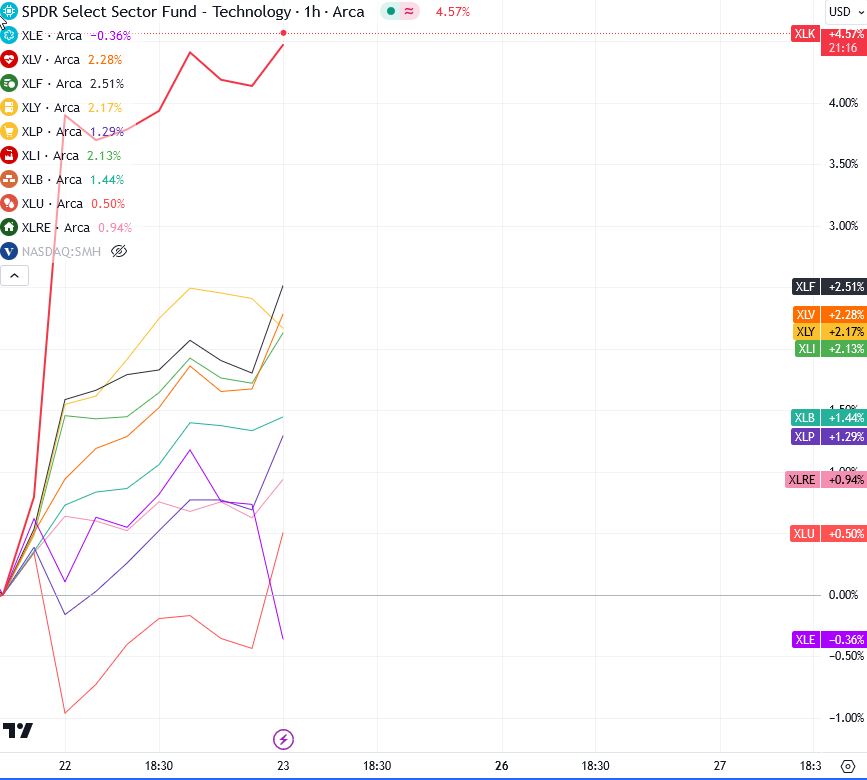

The big story of the week is NVIDIA, which is up almost 20% since Wednesday when they announced that Nvidia has once again beaten the earnings. Technically, the sector remains in good shape, with NASDAQ100 futures trading at a new high. XLK is up more than 4% since Wednesday, while XLF (financials), it’s also not that bad, up 2.5%.

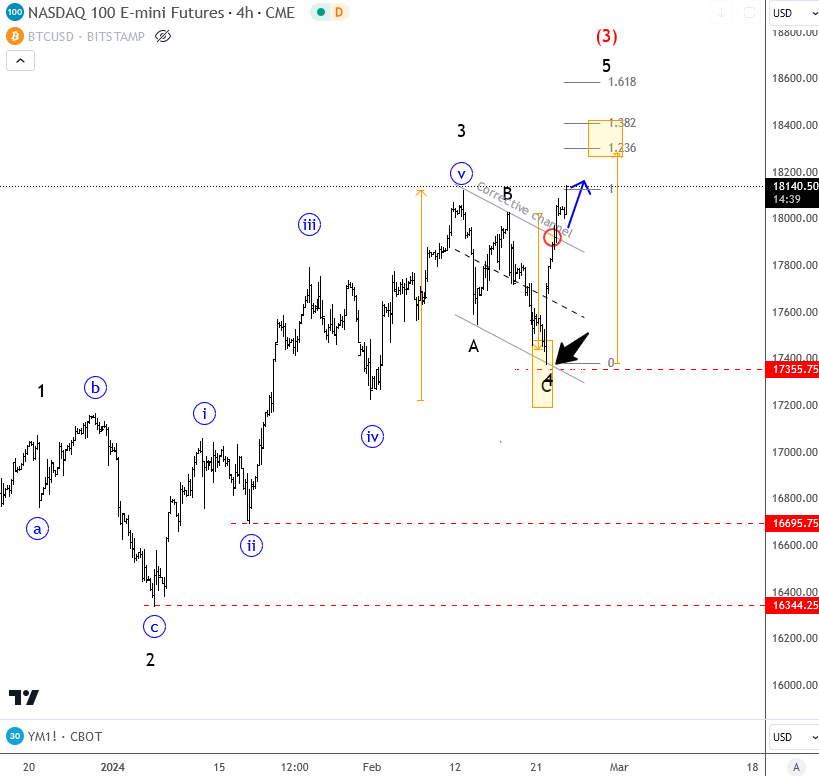

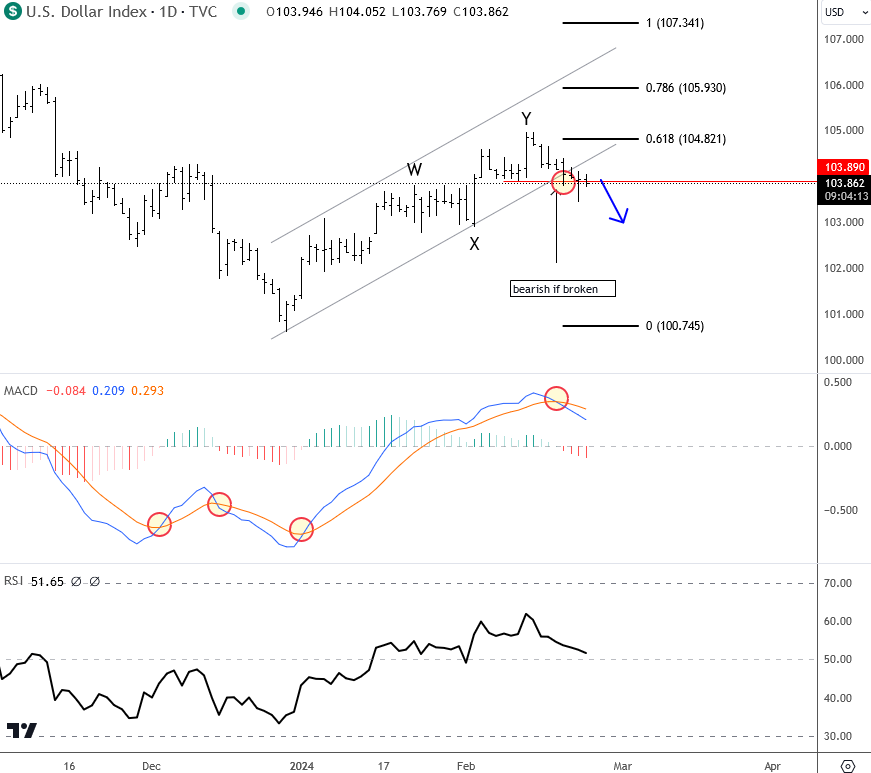

Looking at NASDAQ100 futures, the market is breaking out of the channel and headed into a fifth wave about we have been warning in our free video on Wednesday HERE. So, the move can extend further as we’ll see increased capital inflows into equities, especially at some all-time highs (ATHs). This could lead to a depreciation of the dollar due to the dynamics of these transactions as the focus shifts from currency holdings to equity assets. In fact, I see USD still holding up quite well, but the DXY is coming out of the channel, so wondering if this can be an indication that bulls can’t handle strong stocks anymore. We will see, but it will be important to track US yields as well, which are still testing the resistance. If the dollar and yields come down, then of course, even cryptos can extend further.

For more analysis, check our services, and test us for a month, for only 20€. This offer will expire in less than 48 hours.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.