Hello everyone, I trust your weekend was delightful. We had a splendid celebration for my son Vid’s 11th birthday. It amazes me how swiftly time progresses with children around. Embracing every moment with them is crucial, as these opportunities diminish as they mature.

Shifting focus to the financial markets, we might not witness significant movements today due to holidays in both the US and Canada. On Friday, we observed a dip in the bond market, while the dollar weakened, likely due to position adjustments in anticipation of the long weekend. Interestingly, the Euro managed a notable rally despite a decline in bunds, indicating a potential divergence. However, the Euro and bunds could realign into positive correlation if the bunds stabilize, potentially propelling the Euro even higher.

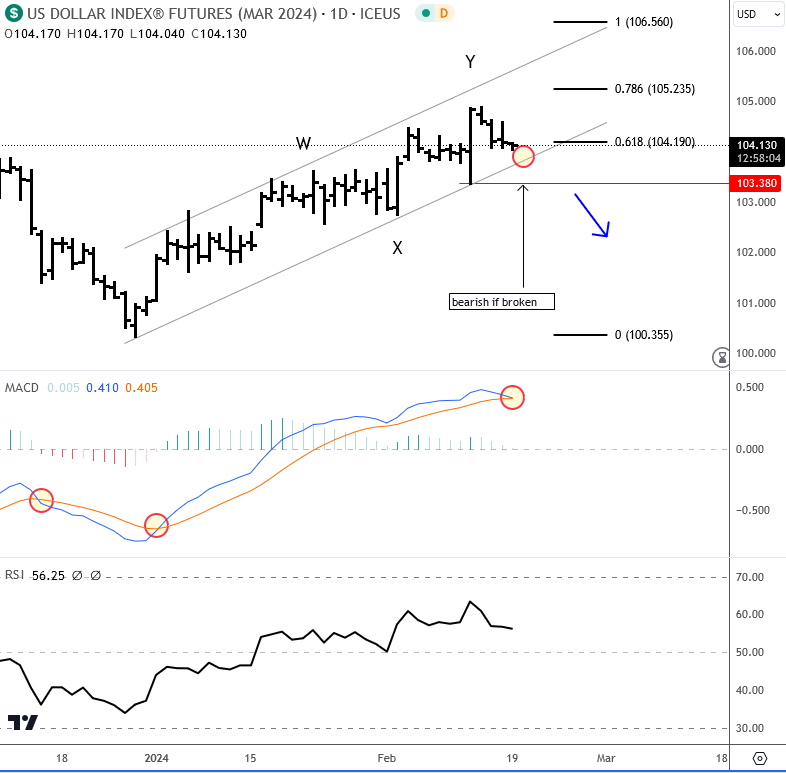

This week, the spotlight turns to the details of the upcoming FOMC meeting that will be released on Wednesday. Any new insights into the Fed’s policy could be pivotal, although substantial shifts are uncommon. Nevertheless, a change in tone could influence yields and the USD significantly. From an Elliott Wave perspective, the DXY appears to be nearing a resistance, possibly already reached, but still need to see a fall below 103.38 to confirm a reversal.

For more analysis make sure to join us in webinar, today at 15CET https://youtube.com/live/1Z9PiQG6auc

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.