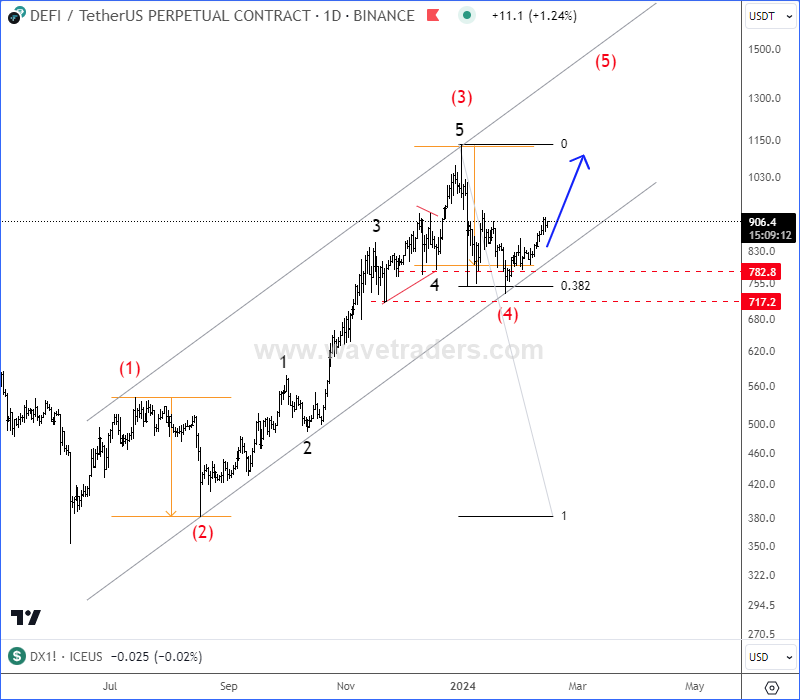

DeFi Index Can Be Rising Within 5th Wave Of An Impulse from technical point of view and by Elliott wave theory.

The DeFi Index is a capitalization-weighted index that tracks the performance of some of the largest protocols in the decentralized finance (DeFi) space. The underlying asset of the DEFI Composite Index perpetual contract consists of a basket of decentralized finance (DeFi) protocol tokens listed on Binance. The index price is calculated using weighted averages of real time prices of the tokens on Binance. The DEFI Composite Index is denominated in USDT.

DeFi Index is trading an in impulsive recovery away from the lows, which is from Elliott wave perspective ideally unfolding a five-wave bullish cycle. After recent corrective slow down, which we see it as a wave (4) correction, seems like it’s now on the way higher within 5th wave that can push DeFi coins higher in upcoming days/weeks.

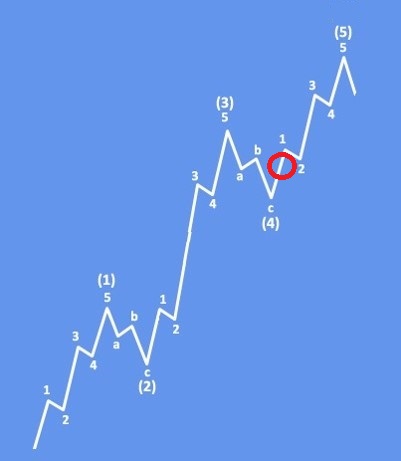

Basic Impulsive Bullish Pattern shows that DeFi may have a completed wave (4) correction and it can be on the way higher for wave (5) within a five-wave bullish cycle of the lower degree.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

TLT Is In A Correction Within Uptrend. Check our free chart HERE.