VIX is a market index that measures the implied volatility of the S&P 500 Index. When SP500 is selling-off, we are in risk-off sentiment and VIX is usually coming higher, which is right now in play after the US CPI inflation report that came higher than expected.

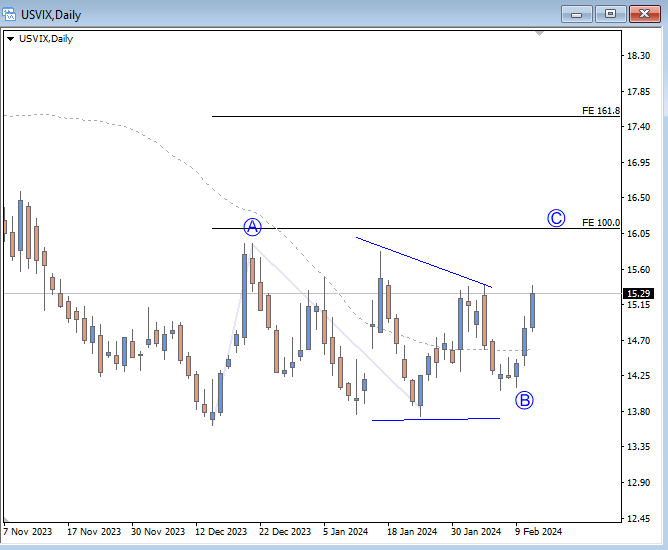

From Elliott wave perspective we see VIX coming higher out of wave B triangle pattern, which means that upside can be limited for wave C, but there’s still space up to 16 resistance area that can send SP500 into deeper correction before bulls show up again.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

US yields at resistance ahead of US CPI. Check our free chart HERE.