GBPJPY has been in a strong bullish phase, but five-wave bullish cycle within wave (5) up from 2022 swing lows can be completed after recent strong reversal down back below channel support lines. In fact, drop from the high is impulsive on a smaller time frame, so it’s wave A that stabilized near 178 support area as expected. As such, current rise is corrective, ideally B wave as a bigger correction before a continuation lower for wave C. Ideal resistance is at that channel support line around 195 – 200 area.

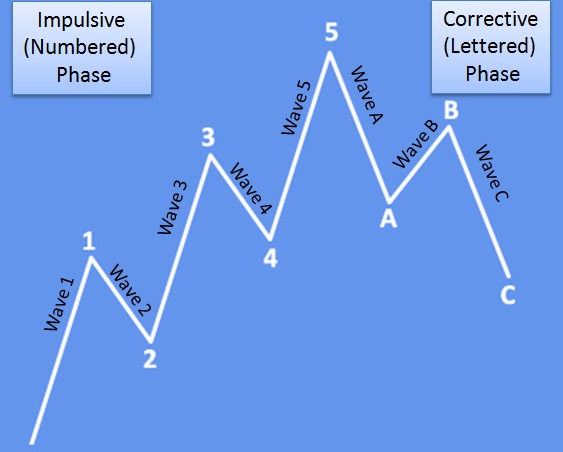

Basic Elliott Wave Pattern shows that after every five-wave movement, we should be aware of a slow down in three waves A-B-C.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.